Valuation Using Price-to-NOA Multiple

The following table provides summary data for Cerner Corporation (CERN) and its competitors, Allscripts Healthcare Solutions Inc. (MDRX) and McKesson Corporation (MCK).

| (in millions) | CERN | MDRX | MCK |

|---|---|---|---|

| Company assumed value | — | $2,063 | $21,063 |

| Equity assumed value | — | $1,607 | $19,962 |

| Net operating assets | $4,296 | $2,007 | $ 9,195 |

| Book value of equity | $4,928 | $1,551 | $ 8,094 |

| Net nonoperating obligations (assets) | $(632) | $456 | $ 1,101 |

| Common shares outstanding | 318.4 shares | 166.7 shares | 184.9 shares |

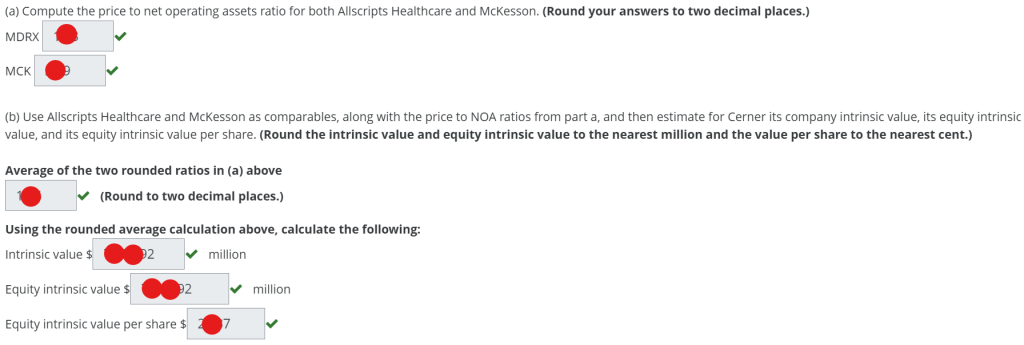

(a) Compute the price to net operating assets ratio for both Allscripts Healthcare and McKesson. (Round your answers to two decimal places.)

(b) Use Allscripts Healthcare and McKesson as comparables, along with the price to NOA ratios from part a, and then estimate for Cerner its company intrinsic value, its equity intrinsic value, and its equity intrinsic value per share. (Round the intrinsic value and equity intrinsic value to the nearest million and the value per share to the nearest cent.)

Solution

Price to net operating assets ratio tells us how much investors are willing to pay for every dollar of the company’s operating assets.

The intrinsic value of a company is an estimate of its true worth based on fundamentals, rather than the market price.

…Please click on the Icon below to purchase the FULL GRADED ANSWER at only $3