Computing Return on Equity and Return on Assets

The following table contains financial statement information for Walmart Inc.

| $ millions | Total Assets | Net Income | Sales | Equity |

|---|---|---|---|---|

| 2018 | $219,295 | $6,670 | $510,329 | $72,496 |

| 2017 | 204,522 | 9,862 | 495,761 | 77,869 |

| 2016 | 198,825 | 13,643 | 481,317 | 77,798 |

a. Compute return on equity (ROE) for the two recent years.

b. Compute return on assets (ROA) for the two recent years.

c. Compute profit margin (PM) for the two recent years.

d. Compute asset turnover (AT) for the two recent years.

- Round ROE, ROA and PM to one decimal place (example: 0.2345 = 23.5%).

- Round AT to two decimal places (example: 1.35).

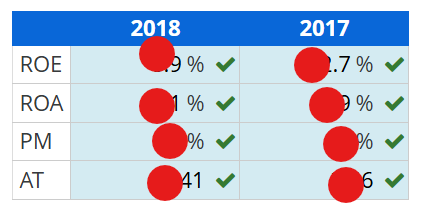

| Ratio | 2018 | 2017 |

|---|---|---|

| ROE | ||

| ROA | ||

| PM | ||

| AT |

e. Which of the following best explains the change in ROA during 2018?

The company’s profitability weakened considerably.

The company’s asset productivity weakened considerably.

The company had higher sales in 2018.The company had higher assets 2018.

Solution

To solve and calculate the ratios you first need to understand and know the formula to apply for each ratio. Our solution shows the breakdown of the formula making it easy for you to apply the knowledge.

Ratio Formula Return on Equity (ROE) ROE=Net Income/Equity×100

Return on Assets (ROA) ROA=Net Income/Total Assets×100

Profit Margin (PM) PM=Net Income/Sales×100

Asset Turnover (AT) AT=Sales/Total Assets

…Please click on the Icon below to purchase the FULL CORRECT ANSWER at only $2