Formulating Financial Statements from Raw Data and Calculating Ratios

Following is selected financial information from General Mills Inc. for its fiscal year ended May 27, 2018 ($ millions).

| Cost of goods sold (COGS) | $10,312.9 | Cash from operating activities | $2,841.0 |

| Cash from investing activities | (8,685.4) | Noncash assets, end of year | 30,225.0 |

| Cash, end of year | 399.0 | Cash from financing activities* | 5,477.3 |

| Income tax expense | 57.3 | Total assets, beginning of year | 21,812.6 |

| Revenue | 15,740.4 | Total liabilities, end of year** | 24,131.6 |

| Total expenses, other than COGS | 3,207.2 | Stockholders’ equity, end of year | 6,492.4 |

| and income tax |

* Cash from financing activities includes the effects of foreign exchange rate fluctuations.

** Total liabilities includes redeemable interest.

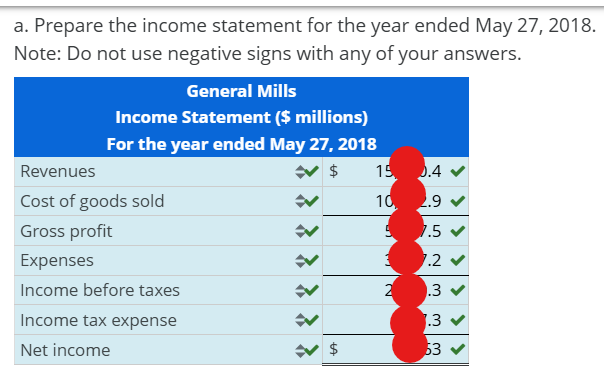

a. Prepare the income statement for the year ended May 27, 2018. Note: Do not use negative signs with any of your answers.

b. Prepare the balance sheet as of May 27, 2018.

c. Prepare the statement of cash flows for the year ended May 27, 2018. Note: Use a negative sign with your answer to indicate cash was used by activities and/or a decrease in cash.

d. Compute ROA.

e. Compute profit margin (PM).

f. Compute asset turnover (AT).

Notes:

Round ROA and PM to one decimal place (ex: 10.5%)

Round Asset turnover to two decimal places (0.33)

| ROA | |

| PM | |

| AT |

Solution

The income statement summarizes and shows the revenues against the expenses incurred to generate the revenues for that period. The bottom line should be the net income generated by the company

…Please click on the Icon below to purchase the FULL GRADED ANSWER at only $3